Deal alert! Northwest will form your LLC for $39 (60% discount). See details.

Statement of Information for California LLCs

Every California LLC is required to file a Statement of Information (sometimes referred to as a “Biennial Report”) every 2 years.

Your first Statement of Information is due within 90 days of your LLC being approved.

This is required in order to keep your LLC in good standing with the California Secretary of State.

California LLC Statement of Information fee

There is a $20 fee to file a Statement of Information.

Preferred method of filing

As of 2025, the California Secretary of State only accepts LLC Statement of Information filings online via BizFile.

What’s the purpose of the Statement of Information?

The purpose of the Statement of Information is to keep your California LLC’s contact information up to date with the Secretary of State.

When is my LLC Statement of Information due?

- Your first Statement of information is due within 90 days of your LLC being approved by the state.

- After that, it’s due every 2 years for the life of your LLC.

First Statement of Information:

Your first California LLC Statement of Information is due within 90 days of your LLC’s approval date.

You can find your LLC’s approval date by:

- looking at your approved Articles of Organization

- or by doing a business search and looking for the “registration date”

Ongoing Statements of Information:

After your first Statement of Information is filed, you are required to file a Statement of Information every 2 years. It’s due by your LLC’s anniversary date.

Your LLC’s anniversary date is the same date your LLC was approved. It’s also the same thing as your “registration date”, as mentioned above.

Your LLC’s anniversary date is the same date your LLC was approved. It’s also the same thing as your “registration date”, as mentioned above.

For example, if your California LLC was approved on August 10th 2025:

- August 10th is your anniversary date

- Your first Statement of Information is due by November 8th 2025 (90 days from August 10th)

- Ongoing Statements of Information are due every 2 years, due by your anniversary date (August 10th 2027, August 20th 2029, August 20th 2031, and so on)

Is there a penalty if I don’t file an LLC Statement of Information?

Yes, there is a penalty.

The Secretary of State will give you a 60-day grace period (counted from the date you have been notified for failure to file) within which you must file the Statement of Information.

If you fail to file within the 60-day grace period, you have to pay a $250 penalty.

(Source: Common penalties and fees; see “Statement of Information penalty”)

If you continue to ignore this requirement, the Secretary of State may administratively dissolving (shut down) your LLC.

Statement of Information reminders

The Secretary of State will send a postcard reminder (by regular mail) to your LLC’s business address 1 to 2 months before the due date.

However, this is a courtesy reminder and even if you don’t receive one, it is still your responsibility to file all your Statements of Information on time.

For this reason, we recommend:

- putting a repeating reminder on your phone and/or computer

- and bookmarking this page

How early can I file?

First Statement of Information:

Again, your first Statement of Information is due within 90 days of your LLC being formed. You can file this Statement of Information as soon as your LLC is approved.

Ongoing Statements of Information:

You can file your ongoing Statements of Information up to 6 months before the due date.

For example, if your next Statement of Information is due by August 10th 2025, you can file it as early as February 10th 2025.

And the same thing applies for upcoming years.

For example, in 2027, you can file your Statement of Information anytime between February 10th 2027 and August 10th 2027.

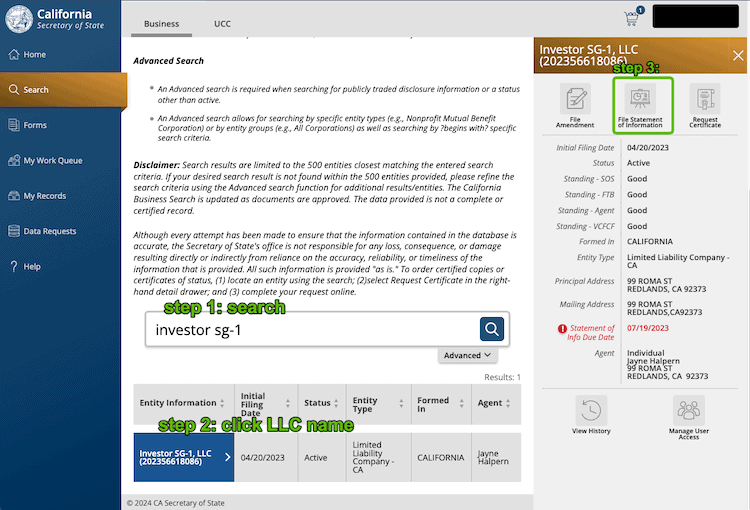

How to file your Statement of Information online

Get started:

- Go the Secretary of State’s BizFile page, scroll down, and click “File Online” (a new tab will open)

- Click “Login” in the upper right.

- Click “File a Statement of Information“

- Search for your LLC either by its name or Entity Number

- Click on your LLC name, and then click File Annual Report

- You may need to “Request Access” if your BizFile account isn’t connected to your LLC

- Login to your BizFile account and continue the filing.

- Review the privacy message and agree to the terms

Submitter Information

Enter the name and contact information for the person submitting the Statement of Information.

The Secretary of State will use this information to contact you with questions about the filing, if they have any.

Note: This section is optional, so you can skip it if you prefer.

Entity Information

There’s nothing to do on this page. It just displays your LLC information.

Business Address – Street Address of Principal Office of LLC

- Related article: Domestic LLC versus Foreign LLC

Review your LLC’s Principal Office address and make any changes if necessary.

Domestic LLC: If your LLC was formed in California, you can enter the same address that you listed in your Articles of Organization (your LLC’s Designated Office address).

Foreign LLC: If your LLC was formed in another state and is registered to do business in California, enter your LLC’s Principal Office. For most Foreign LLCs, this is usually the LLC address in the state in which it was formed.

Some notes about your LLC’s Principal Office address:

- It must be a street address

- It can’t be a PO Box address

- It can be a home address

- It can be an office address

- It can be a friend or family member’s address

If you want to keep your address off public records:

- If you hired the California Registered Agent we recommend, you can use their address for your LLC’s Principal Office address

Business Address – Mailing Address of LLC

Review your LLC’s Mailing Address and make any changes if necessary. The Mailing Address is used to receive paperwork from the state.

If needed, your LLC’s Mailing Address can be the same as its Principal Office address. But it doesn’t have to be.

Some notes about your LLC’s mailing address:

- You can use any address you’d like, as long as you can get mail.

- It can be located in the U.S. or outside the U.S.

- The address can be a PO box address.

Business Address – Street Address of California Office of LLC

If applicable, update or enter your LLC’s California Office address. This only applies to LLCs with a principal office not in California.

Note: This section is optional, and it can be skipped.

Manager(s) or Member(s)

- Related article: Member-managed vs Manager-managed LLC

If your LLC is Manager-managed, you only need to enter the Manager(s) information.

If your LLC is Member-managed, you only need to enter the Member(s) information.

Add your LLC’s first Manager/Member.

Then add any additional Manager(s) or Member(s), if needed.

Agent for Service of Process

Note: Agent for Service of Process is the same thing as a Registered Agent.

- Related lesson: California Registered Agent

Review your LLC’s Registered Agent information and make any changes if needed.

Type of Business

- Related article: LLC business purpose statement

Enter, or edit, the brief description of your LLC’s primary business activity. You can enter a few words or a sentence or two to explain your LLC’s primary business activity.

If your LLC is engaged in multiple business activities, just enter the primary one. Your Information Statement doesn’t have to list every single thing your business does.

Email Notifications

Also on the Type of Business page is the option to request Email Notifications from the Secretary of State. This includes reminders about filings that are due and other notifications.

We recommend entering your email address (twice) in order to get an “approved” copy of your LLC’s Statement of Information by email. Otherwise, they will send it by USPS mail.

Chief Executive Officer

Note: This section is optional. It can be filled in or left blank.

The state defines a CEO as either:

- a person — besides the LLC member(s) or manager(s) — who is appointed to run the company

- or the highest level position in the LLC’s organization in charge of management

If you’d like to enter a CEO for your LLC, you can do so here.

Most filers prefer to leave this information off public record, so they skip this section and leave it blank.

Labor Judgment

This page asks whether any manager or member of your LLC has judgments against them from a Labor Code violation. That includes things like wage disputes, occupational safety, and other employment issues. The judgment could be from a court or from the Division of Labor Standards Enforcement.

Answer Yes or No.

Review and Signature

Review:

Review the information you entered for accuracy. Check for any typos (and go back to make any changes if needed).

Signature:

Once finished, at the bottom of the page, check off the box agreeing to the terms. Then click “Add“. Enter the name of the person signing the Statement of Information. Then click “Save“.

Click “Next Step” to proceed.

Processing Fee Information

The next page shows the total amount due ($20).

Optional (Certified Copy): You have the option of adding a Certified Copy of the filing for an extra $5. This isn’t necessary, and we don’t recommend it. The regular filed copy of the Statement of Information is fine.

File Document

Click “File Online“.

Payment

You’ll see a pop-out on the right side. Click “Pay with Credit Card“.

Enter your billing information and submit your payment to the state.

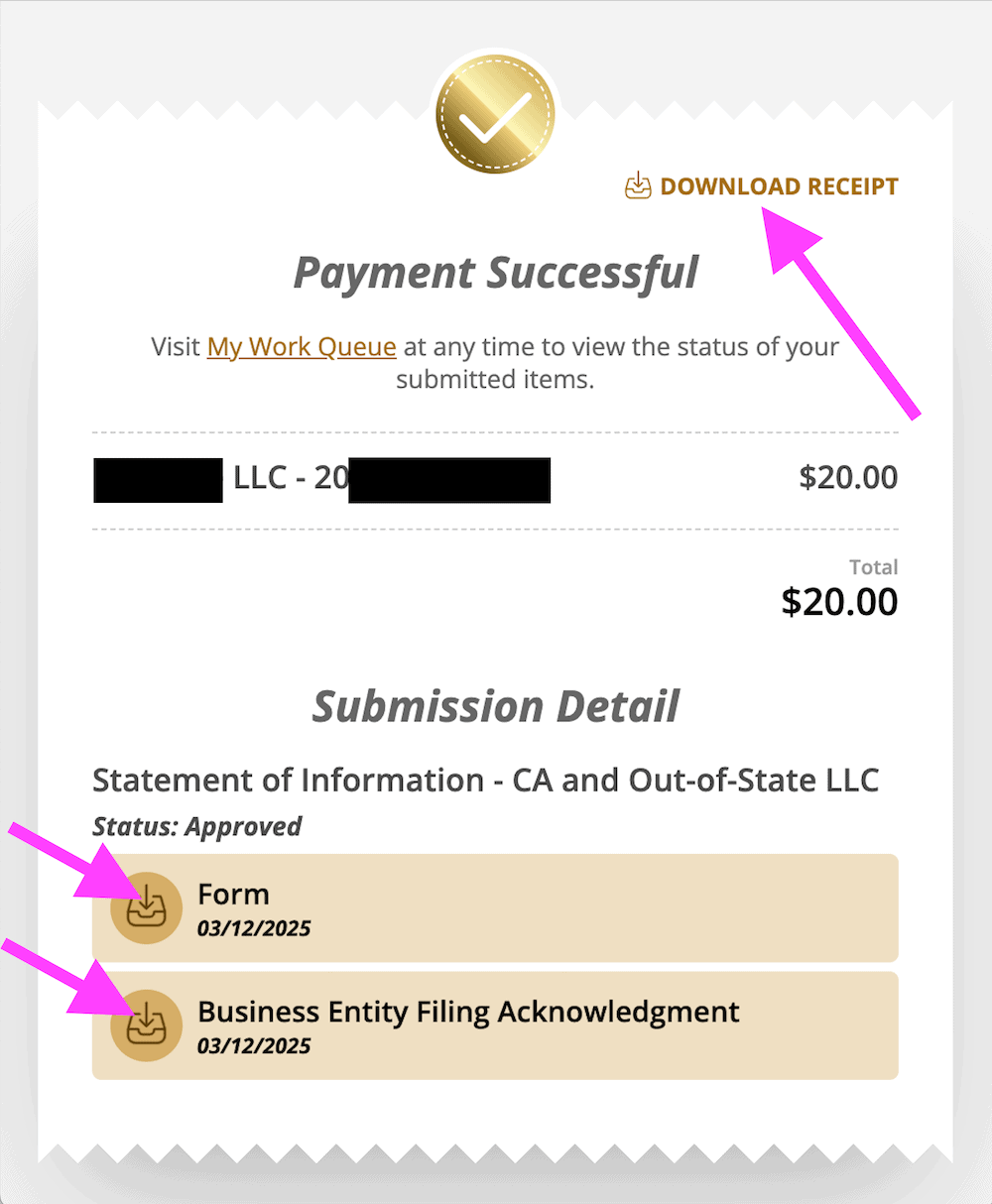

Congratulations! Your California LLC Statement of Information has been sent to the Secretary of State.

Statement of Information Approval (online filing)

When filed online, your Statement of Information is processed and approved immediately.

You’ll see a popup appear and you can download the following 3 items:

- Receipt

- Form (the actual Statement of Information)

- Business Entity Filing Acknowledgment

Note: Technically, these aren’t super important, and you don’t need to save them. Your filed and approved Statement of Information is stored on the state’s business database and you (or the state) can access and download at anytime. Having said that, it doesn’t hurt to save these files with your business records.

File again 2 years from now

Don’t forget to file your Statement of Information again in 2 years.

I recommend setting a calendar reminder :-)

California Secretary of State Contact Info

If you have any questions, you can contact the California Secretary of State at 916-657–5448. Their hours are Monday through Friday from 8am to 5pm, Pacific Time.

References

California Corporations Code: Section 19141

California Secretary of State: About Bizfile

California Corporations Code: Section 17713.07

California Corporations Code: Section 17702.09

California Secretary of State: Current Processing Dates

California Secretary of State: Forms, Samples, and Fees

California Secretary of State: Statements of Information

California Secretary of State: Starting a Business Checklist

California Franchise Tax Board: Common penalties and fees

California Secretary of State: Bizfile California Press Release

California Secretary of State: Statement of Information Help

California Secretary of State: Limited Liability Company Filing Tips

California Secretary of State: Business Programs Contact Information

California Secretary of State: Preclearance and Expedited Filing Services

Matt holds a Bachelor's Degree in business from Drexel University with a concentration in business law. He performs extensive research and analysis to convert state laws into simple instructions anyone can follow to form their LLC - all for free! Read more about Matt Horwitz and LLC University.

Hi matt,

First off, thank you so much for compiling all this information and keeping it up to date!

Using your step by step instructions like a bible, I registered for a single member LLC with California and it got approved as well. I learned along the way and saved some money too. I also took your advice and hired a registered agent to keep my details private as much as possible.

Now for the questions:

1. I noticed that my name shows up in the Articles of Organization which is public information. Could that have been avoided? Remember I did pay for a registered agent and used their details where the process asked.

2. I have the same question for Statement of Information. it has member name and address details in a few places. Are there steps I can follow to keep my name and address completely private?

3. In line with the same privacy concern, in order to open a business checking account, the bank is also asking for business and mailing address. I would like to receive the checks, statements, cards etc at my home. I am hoping the address details I provide to the bank are generally help private. is that a fair assumption?

As you can tell, the theme of my questions is privacy. Any specific suggestions you can give for the next 2 steps – Statement of Information and Business Checking Account would be great.

Thanks in advance.

Hi John, you are very welcome! That is fantastic to hear :)

1. If you filed your LLC yourself, I think you are talking about your name appearing as the LLC Organizer, correct? If so, that could have been avoided by hiring someone to file the LLC for you (and they would sign as the Organizer). You can’t change the LLC Organizer after the filing has been processed with the state.

2. Unless your LLC is a Manager-managed LLC (in that case, you’d list the Manager’s name and not the Members’ names), you’re supposed to list the LLC Members in the Statement of Information. You can use the address of your Registered Agent though (if they allow it) for the address of the Member or Manager.

3. Yes, banking information is private. It’s not publicly accessible, unlike state LLC filings. And yes, you can use a physical address and a mailing address that are different than the address listed on your Articles of Organization and/or Statement of Information. Hope that helps!

Thanks Matt for answering all the questions.

For #1, you thought right. I was indeed talking about LLC Organizer name. Sorry I forgot to mention it in my initial question but it shows how good you know this stuff.

You’re welcome John. Thank you very much ;)

Hi Matt,

As always your website is a treasure of information!!

I am going to set an LLC next week and I have a doubt about what to insert in the field 5. and 8. of the Statement of Information. Hope you can help me to clarify…

The LLC will be a multi-member LLC (two members) and one of them will be the only manager and CEO.

The question is related to the ADDRESS to put in fields 5. (Managers or Members) and 8. (Chief Executive Officer) of the Statement of Information:

– Since the document is public I would prefer not insert the residential address in these fields for privacy reasons. So, is it possible to insert in both 5. and 8. the First name and Last Name of the manager/CEO and the LLC business office address instead of the residential???

I would also hire a Registered Agent (NorthWestern) for the Article of Organization for the same reason (privacy), but if in the State of Information I have to disclosure anyway the residential address I don’t see the point to hire the RA for the AO….

The instructions along with the form llc-12 says:

field 5. “Enter the name and complete business or residential address of any manager(s),

appointed or elected in accordance with the Articles of Organization or Operating

Agreement, or if no manager(s) has been so elected or appointed, the name and

business or residential address of each member.”

field 8. “Enter the name and complete business or residential address of the chief executive officer, if any”

So in theory it seems possible since they accept a business address… but I would like to have your opinion.

Thank you!

Hi Vince! Thank you! Regarding the Statement of Information (Form LLC-12), you can technically leave #8 blank if you’d like. It also may not matter much, since it’ll be the same information you place in #5.

Regarding #5, I assume your LLC is going to be a Manager-managed LLC. If so, you don’t need to attach the LLC-12A (to add additional Members). In that case, yes, you are correct: You just need to list the LLC Manager and yes, you can use the LLC business office address.

Regarding using Northwest’s address in the Articles of Organization (Form LLC-1): You can use their address for the Return Address, Business Address, and of course the Service of Process address. Or if you have an office address, you can just use the office address for all of those address fields and list yourself or the LLC Manager (or another agent or employee of the LLC; who agrees, of course) as the Registered Agent. Hope that helps!

Hey Matt! Thank you SO much for your reply!!

Yes, it is correct, the LLC will be a Manager-managed LLC, where one of the two members (me) will be either manager and CEO.

Perfect then, I will put the office address.

Have a great day!

You’re very welcome Vince! Sounds great :) Thanks, you too!

MR Horwitz, Just wanted to say thanks for all the info you provided. I’m doing my best to start a small trucking company and don’t have too much money and everything I can do myself really helps me and my Family. Again thnk you so much.

Pedro, thank you so much for the nice comment, I’m so happy to hear that :) I wish you nothing but the best in your business!

Very helpful and clear information! I only wish I had read it sooner. Thank you.

Thank you for the nice comment Eveline. You’re welcome :)